EEnvest Project

Risk reduction for Building Energy Efficiency investments

Project Info

Grant Agreement ID: 833112 – H2020 Programme

Start date: July 01, 2019

End date: June 30, 2022

Coordinator: Eurac Research

Partecipants: Global New Energy Finance SL, Sinloc-Sistema Iniziative Locali SpA, Energinvest, Integrated Environmental Solutions Limited, R2M Solution, Politecnico di Milano, Union Internationale de la Propriete Immobiliere, Ecrowd Invest Plataforma de Financiacion Participativa SL

Project website: https://www.eenvest.eu/

Project Description

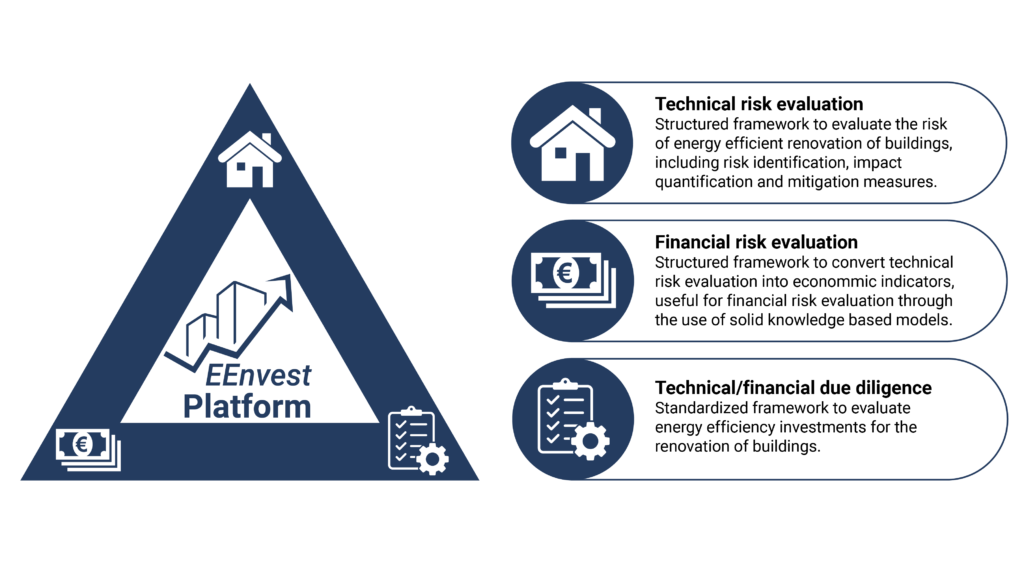

EEnvest aimd at supporting investors´ decision making process by translating building’s energy efficiency technical requirements into economic indicators. These indicators are in turn used to evaluate financial risks associated with deep renovation investment and to include non-energy benefits in asset evaluation models. EEnvest allowed the financial sector to match the EE investments demand and offer for commercial office buildings located in Italy and Spain. EEnvest increased financers’, investors’, owners’ and users’ mutual trust, by identifying, quantifying and mitigating technical risks associated to those investments as well as by reducing the cost of credit for lenders through targeted risk reduction actions. EEnvest developed effective evaluation methods for the technical/financial risk correlation by categorising a number of major technical risks and quantifying their impact on investors´ confidence. Those risks have been i) evaluated exploiting existing databases on building energy efficiency (e.g. DEEP database of Energy Efficincy Financial Institutions Group), ii) organized into investor friendly bechmark track record and iii) transferred on a web-based platform through secured blockchain networks The investment demand and offer have been supported by the EEnvest – search&match investment evaluation web-based platform, integrating building stock evaluation data, both from the technical and the financial side. EEnvest approach is replicabled in more countries and business cases thanks to the standardization of technical/financial due diligence framework for energy efficiency renovation of buildings and to the search&match web-based platform allowing deep renovation investments to be more appealing on the financial market.